In accounting, a journal entry is a record of the financial transactions of a business. The purpose of a journal is to summarise and track these transactions so that they can be analysed and evaluated later.

We have also provided a free accounting journal template available as either a PDF or Word document.

Table of Contents

A journal entry records the business transactions in the financial records.

Journal entries are prepared in a company’s general ledger, including the date, amount, and description of each transaction. Journal entries must balance, meaning the total debits must equal the total credits.

The purpose of a journal entry is to provide a complete record of all the financial transactions made by a business. These comprehensive records can produce financial reports, such as the balance sheet and income statement.

When done correctly, journal entries provide an accurate and timely snapshot of a company’s financial health on the financial statements.

There are two ways of creating journal entries in modern accounting software. They are:

Posting a business transaction in your accounting software creates journal entries that include debits and credits. This journal entry is used to update your books and keep track of your financial activity. The transactions might consist of sales invoices, purchase invoices, credit notes, and payments.

The journal entry ensures that your books are accurate and up-to-date, which is essential for efficient bookkeeping. The journal entry provides a valuable record of your financial activity that can be used for tax purposes or other financial reporting.

Overall, journal entries are essential to accounting and bookkeeping and help keep your finances organised and streamlined.

Here is an accounts payable journal entry example; the entry is in relation to a bill received for website hosting for the business:

When you need to make an adjusting entry to your accounts, you’ll create a manual journal entry. This might be an accrual, prepayment, or correction. Regardless of the reason, journal entries help to keep your finances in order and up-to-date.

The above image shows the entry form in Xero; most accounting packages will look similar to this.

The double entry accounting system is one of the most important foundations of modern accounting. This system records transactions in at least two accounts, each receiving a “debit” and a “credit.” The debits are always equal to the credits, and this balance keeps the books in order.

This system provides a clear audit trail since all transactions are clearly documented. In addition, the double entry system makes it easy to post accounting journals. This process involves recording transactions to the correct accounts and ensuring that the debits and credits are equal.

Accounting software will create double-entry bookkeeping; an example is that you paid from your cash account for an insurance policy of £150. The double entry would be to debit the cash account in the balance sheet and credit insurance in the profit and loss account.

T-accounts are the basis of each account in the general ledger. They show the account name and a list of the debits and credits. They are used in a journal entry to help decide if the journal is a debit or credit. Below is an example of a T-account.

Accounts are listed in the general ledger and used to produce the financial statements. The three primary statements are the balance sheet, income statement, and cash flow statement.

A balance sheet lists all the assets and liabilities of a company at a specific point in time. The income statement shows the revenue and expenses of a company over a period of time. The cash flow statement shows the cash inflows and outflows of a company.

These reports are essential for understanding the financial health of a company. They can help businesses make informed decisions about investing, borrowing, and other financial activities.

The accounting cycle is a step-by-step process that a business will use to produce the accounts. This process includes recording business transactions, classifying them into the appropriate accounts, reviewing the general ledger accounts, making adjustments and then preparing the period reports.

The accounting cycle is vital because it ensures that all financial information is accurate and up-to-date. This process provides a valuable record of a company’s financial activity.

The journal number, transaction date, account codes, description, debit amount, and credit amount are required. The information is put into a form so that a transaction record is kept.

In a journal, the debit and credit amounts must be equal as you move a value from one account code to another. It is possible to make multiple journal entries in one form; this is especially useful at year-end with lots of journals to complete.

There are a few things to keep in mind when creating journal entries:

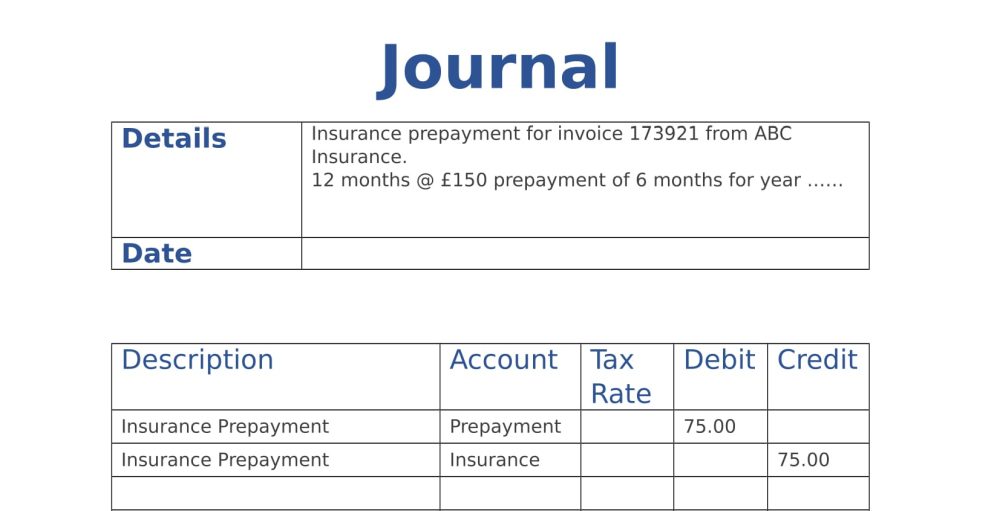

During the year, a business purchases insurance for 12 months for £150, but only six months relate to the current year. A prepayment for 6 months will need to be journaled to correct the figures for the year.

Here is what the original insurance entry to the accounts would have been:

| Debit | Credit |

|---|---|

| Bank | £150 |

| Insurance | £150 |

The journal entry in accounting form would look like this.

Accruals are adjustments made for either a sale that no sales invoice has been issued to the customer or expenses that an invoice that has not yet been received from the supplier. These adjustments must be made to ensure that the final accounts are accurate figures for the financial year.

Examples of accruals journals are

a) Sales were made during the month, but a sales invoice of £1000 has not been issued; a journal is required to correct the accounts.

| Debit | Credit |

|---|---|

| Sales | £1000 |

| Accruals | £1000 |

b) Goods to the value of £60 have been received and sold to a customer (cost of sale); at the period end, the purchase invoice has not been received.

| Debit | Credit |

|---|---|

| Accruals | £60 |

| Cost of Sales | £60 |

In the examples for both prepayment and accruals, when the invoice is received and posted to the ledgers, there will be duplicate figures in the accounts. You will, therefore, need to reverse the journal; most software packages allow you to enter a date to reverse a journal.

One type of journal often used in accounting is the recurring journal. This type of journal records transactions that occur regularly, such as monthly rent payments or weekly payroll expenses. Recurring journals can be beneficial in keeping track of expenses and ensuring that all transactions are accounted for.

There are several reasons a business might need an adjusting entry, including:

You can normally do this with your accounting software if you need to track entries to find a problem. There are several ways of tracking them;

We have designed a general journal entry form that you can download as either a Word document or PDF. Both are free to download and easy to use.

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.